Welcome back,

Most real estate investors do not know the answers to the question, “What price and terms did every past seller you’ve spent time with finally sell their properties for?” While this question may seem daunting at first, a simple tweak in your business practice can provide you more real-world sales data for your niche and additional face-time with possible soon to be motivated sellers.

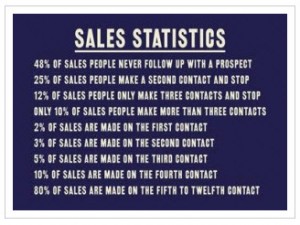

According to followupsuccess.com, 80% of sales are made between the fifth and twelfth contact with a seller. Additionally, 48% of sales people will never follow up with a client. This article will discuss just a few of the ideas to consider when calling sellers back. Additionally, this article will be discussing following-up with sellers you have already made purchase offers to; these sellers have previously said “No” to your purchase attempts and no Win-Win purchase offer has been reached.

Below is dialog from a recent call made to a seller.

Me: “Hello, Mrs. Tomkins. This is John Fedro giving you a call back about your 3 bedroom mobile home for sale in Sunny Dale MHP. I was curious to hear if you have had any more showings or interest from potential buyers since we last spoke.”

Seller: “Hi John. Yes, the home was sold last week to a nice young couple.”

Me: “Oh, good! I am really glad to hear that for you. I am curious, what price did you end up selling the home for?”

Seller: “We sold the home for $8,500.”

Me: “Congratulations Mrs. Tomkins. I am very happy for you and your family. The home was worth every bit of that. The buyers got themselves a beautiful home. In the future if you have any other real estate concerns or another mobile home for sale please don’t hesitate to ever call me anytime. Congratulations again.”

Following up with sellers should already be a mandatory part of your real estate investing business. To assume a seller’s current “No” to your purchase offer is permanent is unwise and simply untrue. Seller’s become more flexible overtime. As the market shows the seller’s original price was too high, your purchase offer becomes more and more realistic.

Continue following up with sellers as long as their homes are for sale and they are happy to hear from you. The number and proximity between each phone call or letter can depend on the motivation level of the seller and how close to a Win-Win deal you are both becoming.

Here are just a few benefits to following up with sellers:

1. Word of mouth referrals:Simply calling sellers back allows them to hear your voice and name again. Additionally, being proactive and genuinely interested in helping each seller is a great way to expand your circle of influence. Sellers often know other owners/sellers that may or will need to sell eventually.

2. Hear valuable first-hand information: “Have there been any showings to potential buyers?” “Any new buyer potential buyers?” Any purchase contracts accepted?” “Is the asking price still the same?” Ask these questions to better understand your negotiations and the seller’s current situation.

Always aim to provide clarity and help to every seller you interact with. More than simply offering a fair price for most properties, investors aim to listen to sellers and give experienced filled advice and options to improve a seller’s situation.

3. Top of the Mind Awareness Through Others (TOMATO):Sellers understand that we are real estate investors. As real estate investors we purchase and are knowledgeable in real estate matters. The more time a seller spends with you and remembers your name, face, message, and phone number the further in the front of their minds you may remain. When the time is right and a sellermust sell, your name may be the first one they call. The squeaky wheel get the grease.

4. Congratulating the seller:Sometimes sellers find alternative solutions for their selling needs. That is very OK. Share in a seller’s happiness. Too often you may hear from sellers whom you cannot help, and you know a foreclosureor further heartache is imminent. If you have been investing for any period of time you may have experience dealing with sellers in tight-financial situations with nothing you can offer to help besides advice.

At the beginning of this article I mentioned a quick bit of dialogue discusses during a recent conversation between a mobile home seller and myself. Mrs. Tompkins had been trying to sell her home for over 4 months with no success. We had previously met once and spoken via phone multiple times about her property. Three hours or less time spent in total with the seller. She is a mother, widow, painter, and hard-working woman. When I heard she sold her home for almost what she wanted I was very happy for here. As we should aim to be with every seller we deal with.

What can we learn from a home that is already sold? First things first, if the home is not technically closed on then there is a chance the potential buyer will bail or be unable to close, thus giving you the continued opportunity to create value with the seller. However if the seller’s property did sell then this would be a good time to ask permission to find out from them…

- When the home sold? Will give you additional information about the number of days on the market for this street in your market.

- To another investor or end-user? Who is working in your general area? Did another investor pay a higher price or give more favorable terms? If yes, is there anything else you could have done or learned to do differently?

- The final sales price?* How low the seller was really willing to drop down in price. In the future it would be wise to remember this negotiation and the seller’s final price and terms. *In some states the sold price may be free public information, while in other states this sale data is kept confidential.

Seller situations change from month to month, week to week, and day to day. A once wishy-washy seller can develop into a motivated seller over months or days. It is important to be remembered at this tipping point when a seller realizes that a fast sale may not be possible without you.

Try this: Start following up with your past sellers. Aim to say Hi, reintroduce yourself, and get an update from each seller as to what has changed since you both last spoke. Begin with the past 2-4 weeks and call the past sellers you have made unsuccessful purchase offers to. Do not call with the expectation of making any deals, simply call for a quick 1-4 minute chit-chat or quick voice-mail message.

Conclusion: If a seller does not remember you or that you buy homes, it is not their fault. Make sure to be following up with sellers regularly. Some sellers will have sold. Some sellers will have decided not to sell. Some sellers will have not changed anything. While other sellers will realize their asking price/terms are too high and that your original purchase offers are fair and reasonable.

Love what you do daily,

John Fedro

Related videos:

Sources:

- http://followupsuccess.com/2011/02/21/shocking-sales-statistics-as-it-relates-to-follow-up/

- http://www.q4intel.com/crushing-mediocrity/sales-development/9-shocking-sales-statistics-that-determine-your-success